Payoneer Review: Getting Paid the Right Way

|

For many people who work from home, getting paid is a real challenge. They may find a suitable and reliable way to create a money flow but at that point, they ignore how to actually cash out. This is especially true for people outside the U.S, where only a few billing services are available. If you are working as a freelance or providing any kind of service online, you have to think in the way to get paid during the early planning stages. It’s simply nonsense to have our money locked up or away from our hands only because we don’t know how to actually receive it. That’s why we decided to make a Payoneer review.

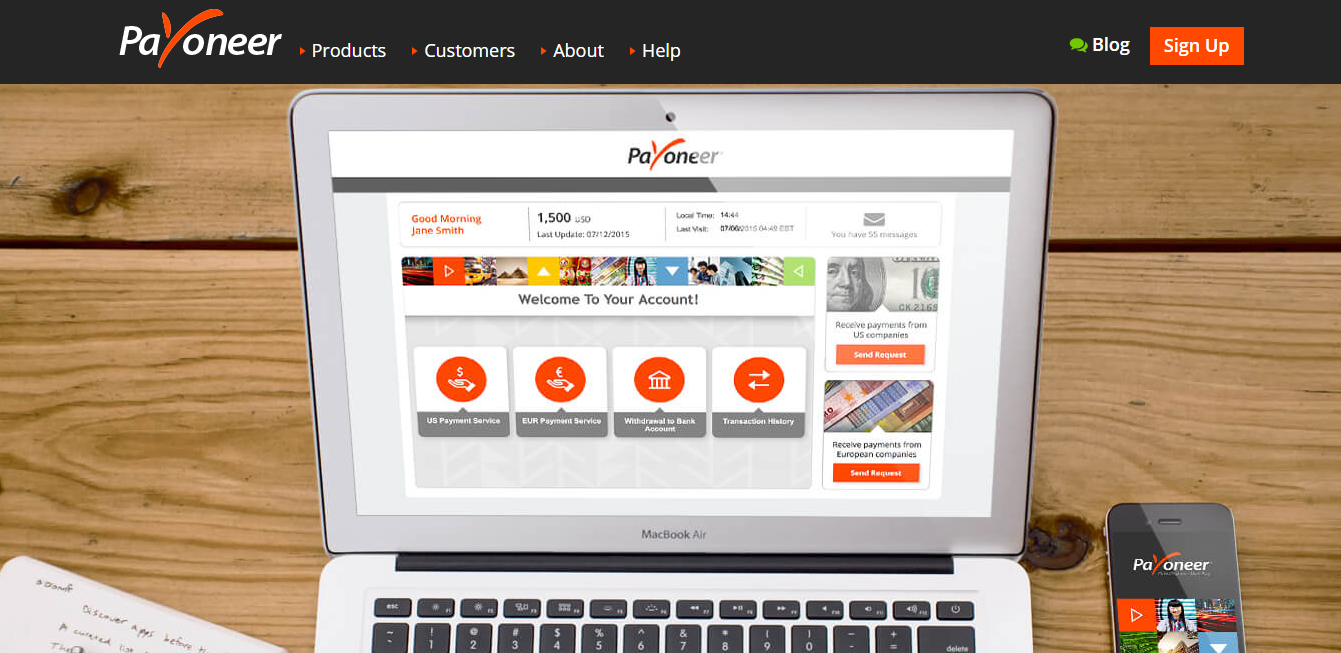

This is one of the most complete and reliable ways to get paid online, leaving aside all the hassle and enjoying most perks. In the following lines, we will address what Payoneer is, the prepaid MasterCard they offer, drawing money to local bank accounts, and some considerations for you as a worker from home. |

What is Payoneer?

Payoneer is a financial service company that is dedicated to providing online payment solutions as money transfers for freelance and direct e-Commerce payments. Back to 2005, it was founded with limited concepts about the online solutions they are now offering. Fortunately, its expansion became more aggressive, allowing Payoneer to go further in terms of markets, partnerships, and features. Anyone can sign up in Payoneer, delivering detailed data about its identity and address. Setting up an account is totally free and there is only an activation fee when the prepaid MasterCard arrives and funds are charged to it.But before that point, the user doesn’t have to pay a cent. Payoneer is also a registered Member Service Provider of the well-known MasterCard Incorporated. This adds plenty of customer trust to the service and we consider that a fundamental key for our Payoneer review.

Payoneer is directly competing with payments methods like PayPal and Bitcoin, growing in popularity every day as freelance-work companies like Fiverr and UpWork add it as one of the main alternatives to withdrawing funds. But one of the best things is the Global Mass Payments, which is a feature that allows users to get paid from any client they may have all around the world, only by using a credit card. Once you receive a payment, it can be available within two hours or two days, depending on the charging fee you may want to pay. It’s necessary to mention that the quick availability of the payment, which is in two hours, charges a $3 fee, while the standard availability of two days deducts a $1 fee. Now, once you get your money available in your account, you have two ways to move those funds: prepaid MasterCard and bank transfer. Let’s address these topics.

Payoneer is directly competing with payments methods like PayPal and Bitcoin, growing in popularity every day as freelance-work companies like Fiverr and UpWork add it as one of the main alternatives to withdrawing funds. But one of the best things is the Global Mass Payments, which is a feature that allows users to get paid from any client they may have all around the world, only by using a credit card. Once you receive a payment, it can be available within two hours or two days, depending on the charging fee you may want to pay. It’s necessary to mention that the quick availability of the payment, which is in two hours, charges a $3 fee, while the standard availability of two days deducts a $1 fee. Now, once you get your money available in your account, you have two ways to move those funds: prepaid MasterCard and bank transfer. Let’s address these topics.

Getting Your Card

As we already mentioned, in the very moment we get our Payoneer account, they ship us a prepaid MasterCard. This is a highly valid instrument that can be used in business establishments, online stores, and ATM for cash withdrawal. Being a MasterCard prepaid card, it’s highly safe and offers great fees. There is a $4 fee for every withdrawal in at an ATM, which may seem high. Our recommendation is to limit this method and get your cash only when a considerable amount of money is going to be withdrawn. Paying with your card at a local establishment or online don’t apply a fee. Notice that there is no other company that offers that flexibility to move your money around. PayPal also has a prepaid card to do the same but it’s extremely hard to get, especially for people outside the U.S. The Payoneer’s prepaid MasterCard is shipped worldwide, so no worries about the place you live in.

Transferring to You Bank Account

Depending on the financial legislation of your country, you can also transfer the funds available in Payoneer to a local bank account. For many people with favorable conditions, this is a great alternative. But, notice that every country is different and the legal framework could make things impossible. First, if your country has any form of exchange control, you can forget about this bank method. Also, banking fees may be really high, so it’s worth our time to ask important questions before making any move.

Should I Sign Up?

If you want to work from home and have the best resources to get paid, getting a Payoneer account is a good idea. It doesn’t matter the chosen cash flow, we always need a reliable method to get the money into our pockets. This is key to maintain an online stable business. If not, we are always in danger of losing our profits. A good selling point about this service and one that we want to highlight on our Payoneer review is the prepaid MasterCard they offer, free of charge. This feature is simply amazing because it gives us great freedom to use it at ATMs, shop online, and subscribe to memberships like Netflix and similar services, something impossible if we don’t have a credit card at hand.

Payoneer has demonstrated that it is a serious company with the mission to provide reliable services to all customers around the world. Its latest expansions were in India and the Philippines, looking to fulfilling local demands that were harder to satisfy from overseas. The chosen countries may be defined by the high amounts of freelance workers in them. India offers a massive outsourcing industry and the Philippines has become a popular destination for income-steady freelance workers to live the dream.

The Bottom Line

Our Payoneer review has one mission and it’s to explain the many perks of this financial service to people who want to work from home, receiving online payments in exchange for their services. As we previously mention, how to get paid is equally important than how to produce that money in first place. That’s why we cannot wait until the last moment to get a payment method like this one and be prepared for anything could come up on the way.